Once you’ve decided to outsource your bookkeeping, how to you decide which service to use?

The first step in properly vetting any new bookkeeping provider is to understand what your company needs and which solutions have the features and services to meet them. Getting clear on this before you make a switch ensures that when you do make the change, you really improve your business’s back end.

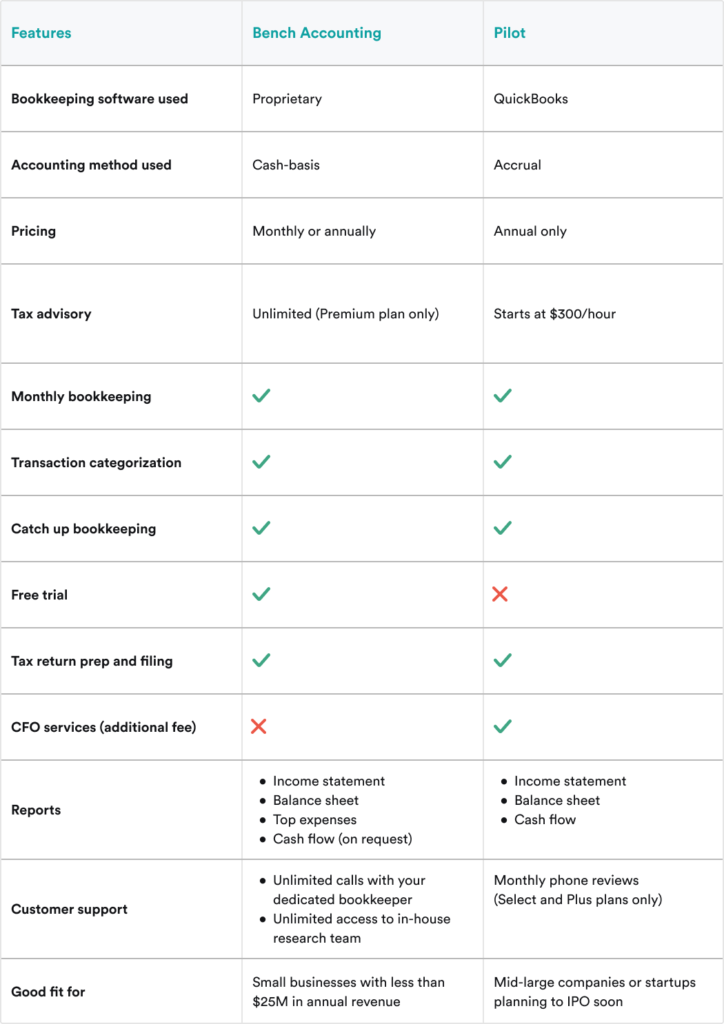

Here’s a comparison of two of the most popular bookkeeping services for small businesses, Pilot vs. Bench, to help you find the right one for you.

Pilot vs. Bench: a quick rundown

Both Pilot and Bench offer bookkeeping services that link your bank accounts and business credit card accounts and automatically record and classify your transactions.

Bench’s pricing starts at $249 per month when billed annually, versus $599 per month for Pilot, making Bench a more accessible option for small business owners and startups.

Both services also offer tax advisory and tax return preparation for an additional fee.

Bench is more established than Pilot—we’ve been serving small businesses since 2012, versus 2016 for Pilot, and have 2.5X more employees than Pilot, giving us an unmatched depth of expertise.

Plus, Bench has nearly 700 reviews on Trustpilot and 64 reviews on G2, versus two Trustpilot reviews and 35 G2 reviews for Pilot.

Features comparison

Both Bench and Pilot provide the essential bookkeeping services small businesses need, such as recording transactions, providing cash flow information, and generating monthly reports that show how your business is doing financially.

However, there are some crucial differences in each service’s features. This chart offers a brief overview, but we’ll also look at each of those in more detail.

Support offered

As a Bench bookkeeping client, you’re entitled to unlimited communication with our team, with a maximum response time of 24 hours. You can schedule calls with your dedicated bookkeeper on an unlimited basis, at all pricing levels, whether you need a monthly check-in or a year-end review. If you’re looking for more complex business information, you can also take advantage of unlimited communication with Bench’s in-house research team at no extra cost.

Some of the things your research team can help with include:

- Sales tax and changing your tax filing status

- Understanding notices from the IRS or state taxing authorities

- Providing general information on business best practices

Bench clients who use Bench for tax filing and tax advisory are welcome to speak with their advisor as frequently as they’d like, too! Our licensed, in-house advisory team will advise on tax planning and efficiency—it’s like having a CPA on staff without the expensive billable hours.

Pilot customers in the Core bookkeeping package have limited support options. You’d have to upgrade to the Select plan, which costs an extra $250 per month at a minimum, to get monthly phone reviews with a bookkeeper.

And if you need advice beyond bookkeeping, you have to add CFO services to your bookkeeping package. That add-on runs, at a minimum, $1,050 per month for up to three hours of advice on financial statements, business metrics, and monthly rolling financial forecasts.

In short, Pilot allows its customers to communicate with bookkeeping and accounting professionals as well, it just comes at a higher price point—especially for CFO-level support.

Accounting method used

Bench provides clients with cash-basis bookkeeping. With this system, bookkeepers record transactions when the money has been deposited into the client’s bank account or charged to their bank or credit card.

Bench bookkeepers can also complete a modified form of cash-basis accounting by making accrual adjustments. Those adjustments include:

- Tracking outstanding accounts receivables and payables. This helps ensure your customers are paying on time and you’re paying your bills on time, too.

- Tracking annual subscription revenue on a monthly basis. When you charge your customers a fee in advance for a service you’ll deliver over a period of time, you haven’t yet “earned” all of that revenue. Tracking the revenue you’ve earned versus unearned revenue that could theoretically have to be returned to customers provides a more accurate picture of your businesses finances.

- Tracking client reimbursements. By accurately tracking unearned revenue, it’s also easier to handle customer cancellations and reimbursements quickly and efficiently. Plus, if you’re issuing more refunds than normal, you can spot the trend quickly and make changes to reverse it.

Using modified cash basis accounting provides more information than you’ll find with basic cash-basis accounting, but with less time and effort than is needed to maintain a full set of accrual accounting records. Essentially, making accrual adjustments gives our clients better insight in a cost-effective way.

Accrual bookkeeping, which records revenue when earned and expenses when paid, regardless of when cash changes hands, is usually only required for large companies that need GAAP-based financial statements.

In fact, a 2016 survey we conducted of U.S. business owners found that more than 80% of U.S. small businesses do their books using the cash basis of accounting. However, if your external CPA recommends accrual accounting for your tax filing, he or she can easily use your Bench-provided cash-basis financial statements to file an accrual-basis return. Because your books are in order, the conversion process is easily handled.

Pilot, on the other hand, does all their clients’ books on the accrual basis of accounting.

If you’re unsure which method you should be using, it helps to consider your company’s growth plan for the future. If you’re approaching $25M in revenue or planning to IPO soon, then you should be using the accrual method and Pilot will be the best choice.

But if you’re like most small businesses in the U.S., then cash-basis accounting, and Bench, will likely work well for you and be the easiest to use.

Pricing

Bench has a lower point of entry for pricing. The Essential plan is $249 per month when billed annually. That price includes monthly bookkeeping, a dedicated bookkeeping team, year-end tax-ready financial statements, and unlimited direct communication with Bench’s team of experts.

Our full-time research team is dedicated to answering tough questions and staying up to date on any IRS policy changes. When you have a question, your Bench team will always get back to you within 24 hours.

For $399 per month (when billed annually), Bench’s Premium package includes everything from the Essential plan, plus one-on-one income tax consulting and annual filing for your income tax return.

Bench also offers catch-up bookkeeping for $299 per month if you need to get your books up to date quickly.

Pilot’s base package–the Core plan–starts at $599 per month when billed annually. That plan includes monthly bookkeeping and financial statements. However, that pricing is only available to customers with up to roughly $30,000 in monthly expenses. If your expenses are greater than that cap, the monthly price will be higher.

The Select plan starts at $849 per month, and customers receive financial ratios, expedited delivery of their monthly bookkeeping, monthly phone reviews, and priority support. Again, that price is only available to customers with roughly $30,000 or less in monthly expenses, so companies with more expenses will pay a higher fee.

Pilot’s Plus plan includes everything from the Core plan but supports multiple entities and locations. It also includes accounts receivable (AR), accounts payable (AP), inventory tracking, billable expenses, and a customizable chart of accounts. Pricing for the Plus plan isn’t publicly available.

Pilot also charges an onboarding fee equal to one month of bookkeeping. Pilot customers can add tax return preparation to any plan for an additional cost, starting at $1,950 per year.

Free trial

Choosing an online bookkeeping service is a big decision, and nobody wants to get locked into paying for a service that doesn’t work for them.

That’s why Bench offers a free trial. The trial includes one historical month of bookkeeping and a full tour of the Bench platform. Even if you choose not to continue after your free trial is up, you can keep the income statement and balance sheet prepared by your Bench bookkeeper.

Pilot does not offer a free trial. When customers sign up, they pay for a full year of bookkeeping up front. If you’re unsatisfied with the service and choose to leave, you’re still locked in to pay for a full year of service. Plus, prepaying for a year doesn’t lock in pricing for the year. For any month in which expenses exceed the cap for the pricing level, Pilot will bill for the difference.

Bench only performs pricing reviews annually, so you won’t be penalized for growing your business!

Bookkeeping software used

Bench does our client’s bookkeeping using proprietary software that was designed to make it easy for our clients to file taxes and understand their business finances.

Every report accessible in the Bench accounting platform can be exported to universal Excel files for easy sharing with lenders, business partners, CPAs, and tax advisors. This makes it easy to take your data with you when you decide to move on from Bench. Plus, Bench clients have lifetime access to their Bench account, so you can jump back in at any time.

Bench also integrates with widely used applications, including Stripe, Square, Gusto, BigCommerce, Shopify, and FreshBooks. These applications help with invoicing, payroll, and more to facilitate a more hands-off experience.

Pilot does all of its bookkeeping in QuickBooks Online–one of the most common DIY accounting software solutions on the market. So if you’re fed up with QuickBooks and want a better solution, you won’t yet be waving it goodbye with Pilot.

If you ever decide to move on from Pilot—either to go back to handling your bookkeeping on your own or to another outsourced accounting service or accounting firm—you can take your data with you, just like with Bench.

Resources

Running a business can be tough–and not just when it comes to dealing with business finances. That’s why Bench strives to stay on the cutting edge of what matters to small business owners. We offer many resources for small business owners, such as:

- The Bench blog with accounting, bookkeeping and tax tips, as well as information on starting a business and managing operations

- Guides, videos, and templates on topics ranging from outsourcing to choosing a business entity, automation, and writing a business plan

- A Tax Resource Hub to help with deadlines, tax deductions, filing support, and more

- Diversity, equity, and inclusion (DEI) resources as part of our commitment to becoming an anti-racist and anti-discriminatory company, amplifying the voices of BIPOC business owners, and providing other resources for minority-owned businesses

Pilot also offers several resources for small business owners, including:

- A blog with tips for starting a business, paying taxes, and handling back office operations

- A variety of guides on subjects ranging from key performance indicators to budgeting

- On-demand webinars with small business tips, tax updates, and financial information.

Need more help choosing?

If you’re still unsure whether Bench or Pilot is the right online bookkeeping service for you, why not try a free trial of Bench?

Once we gather the information needed to complete one month of bookkeeping, we can complete your financial statements within one to two business days. That includes reconciling accounts, categorizing transactions, and making any necessary adjustments to your books.

We’ll also review your financial statements with you over the phone and answer any other questions you might have about our services before you make any financial commitment.

How Bench can help

Bench is America’s largest professional bookkeeping service for small businesses! To date, our accomplishments include:

- $100+ billion worth of transactions reconciled with Bench

- More than 1 million months of bookkeeping delivered

- More than 25K small businesses have used Bench

We handle your bookkeeping and tax filing for you so you can focus on running your business.

If handling bookkeeping on your own has become a dreaded chore or is taking up valuable time that could be better spent on other crucial business tasks, our dedicated team of expert bookkeepers can help. Let us take the accounting tasks off your plate and provide valuable insights to help you move your business in the right direction. Get started for free.

What’s Bench?

We’re an online bookkeeping service powered by real humans. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Get started with a free month of bookkeeping.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

![Read more about the article How to Pay Yourself From an LLC [2022 Guide]](https://osmart-accountant.com/wp-content/uploads/2022/07/dollar-2091742__340.webp)